Labuan Foundation

A unique wealth holding, preservation and protection tool — one of its kind in the whole of Asia.

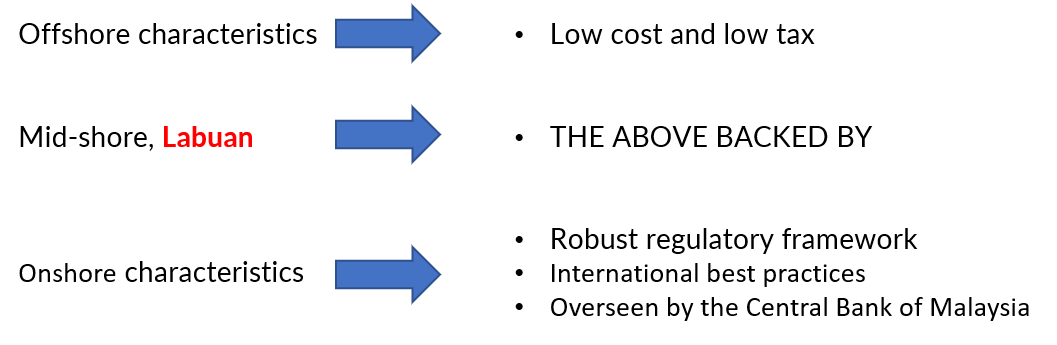

Why Labuan?

Labuan International Business and Financial Centre (Labuan IBFC) presents a wide range of business enabling solutions striking ideal balance between client confidentiality, cost efficiency and compliance with international best standards and practices. As a 'mid-shore' international business and financial centre, Labuan IBFC offers the best of both off-shore and on-shore jurisdictions combined.

The Wealth Succession Solution

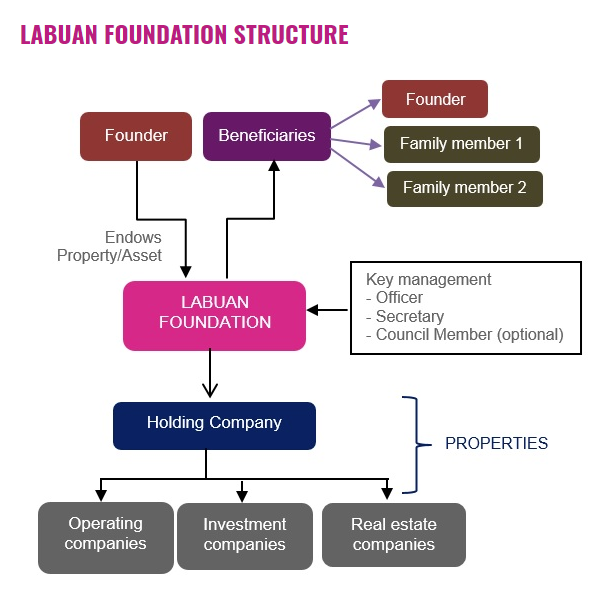

A Labuan foundation is a unique wealth holding, preservation and protection tool which is one of its kind in the whole of Asia. A foundation is a legally registered entity for managing wealth.

The foundation may be viewed as a hybrid between a trust and company. It provides all the protection of a trust with a familiar structure of a company. It can be used as a family office to ensure dynastic succession, investment management and family governance too.

A foundation is a highly effective succession tool to avoid the probate process, inheritance tax and preserving family legacy.

The Benefits

"…a particular feature of Labuan's Foundations Law is the introduction into it of important features from Labuan's Trust Law covering asset protection, anti-forced heirship, liability, migration of foundations, and secrecy and provision of information."

Source: Mark Lea, Partner at Lea & White

"Except as otherwise provided by the Act, the Court or the Charter and Articles, every member of the Council, Supervisory Person, Officer, or Secretary shall deal with and treat all documents and information relating to a Labuan foundation as secret and confidential."

Protected by secrecy clause of Labuan Foundation Act 2010

Key Advantages

Registered corporate body with separate legal entity.

Unenforceable foreign claims or judgments — cannot be forcefully liquidated to satisfy obligations such as claims arising from divorce, lawsuit, creditors or customary inheritance claims (after 2 years).

Protection against forced heirship.

Information concerning the Labuan foundation is not on any public record.

The identities of the Beneficiaries and Founder are only known to the Secretary (Labuan Trust Company).

No tax in Labuan on non-trading activities. No withholding tax, capital gain tax, or inheritance tax.

Founder can reserve powers and rights over the property endowed in a foundation.

Distributions by a Labuan foundation to its beneficiaries are tax-exempted in Labuan. (However, beneficiaries will need to satisfy their own tax liabilities in their respective jurisdictions of tax residence).

No foreign exchange controls.

No stamp duty on all instruments relating to offshore business activities.

All Council members can be family members. Allow re-domiciliation to other recognised jurisdictions.

Labuan Foundation for Your Wealth

Labuan Foundation for Wealth Acquisition

- A foundation is a registered entity. Hence, foundations are able to enter into contracts.

- Avoid delays in obtaining probate (both in Malaysia and overseas) or in the registration of fractional interests in property.

Labuan Foundation for Wealth Preservation

- Fully protected against creditors after the fraud disposition period of two (2) years from the date of registration.

- Unenforceability of foreign claim or judgment, i.e. succession rights, divorce, heirship, personal law, etc.

- Confidentiality provided by the Labuan Foundation Act. (Rights to who may have access to information clearly explained).

- Allows more control to the founder than a trust. (For example: the Founder can appoint himself/herself as the sole Council member, hence controlling the whole foundation).

- Safeguard the founder's interest, enabling legacy planning, succession, control and protection thereby, avoiding the break-up of family assets and ensuring the continuity of the family wealth over generations.

Labuan Foundation for Wealth Distribution

- Labuan IBFC's tax system is simple and straightforward.

- A beneficiary can be added and removed by the founder and Council seamlessly.

- Founder may appoint himself to be the sole beneficiary of the foundation.

Labuan Foundation — Low Cost, High Benefit

In order to set up a Labuan Foundation, please contact us for further detail.